March 11, 2024

By: PhoenixBizz Staff Writer

PhoenixBizz is a division of Sofvue, LLC

Printed with permission of Data Titan and Sofvue LLC

What is an Insurance Mobile App?

An insurance mobile app serves as a digital tool for insurance companies to offer their services efficiently and conveniently through mobile devices like smartphones and tablets. These applications provide immediate support to users at every stage of their insurance experience. From exploring insurance options to receiving assistance with claims, an insurance mobile app simplifies these processes using cutting-edge technology to satisfy user needs.

Why Does Your Insurance Business Need a Mobile App?

Launching a mobile app for your insurance services can achieve multiple goals and deliver substantial advantages to your organization. Such apps establish a digital platform that simplifies the execution of intricate tasks for both customers and insurers. They make the claims process more efficient by allowing for the digital submission of forms and documents. However, these benefits are just the beginning of what an insurance mobile app can provide.

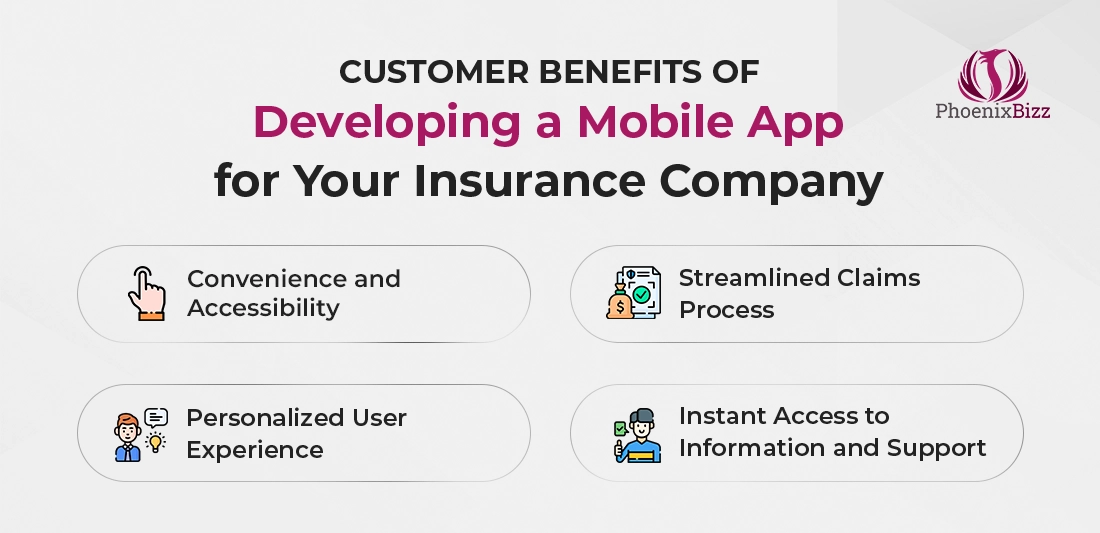

Customer Benefits

There are numerous benefits in developing a mobile app for your insurance company. Some of these include:

➤ Convenience and Accessibility: Customers can access their insurance services anytime and anywhere, right from their mobile devices. This means they can manage their policies, file claims, and contact customer support without being tied to a physical location or constrained by business hours.

➤ Streamlined Claims Process: The app can significantly simplify the claims process, allowing customers to submit claims digitally by uploading necessary documents and photos directly through the app. This not only speeds up the claims process but also makes it more user-friendly, reducing stress and confusion for customers during potentially difficult times.

➤ Personalized User Experience: Mobile apps can offer personalized experiences to users by leveraging data analytics and AI. They can provide tailored insurance recommendations, policy updates, and proactive alerts about policy renewals or claims status. This personalization can lead to higher customer satisfaction and loyalty.

➤ Instant Access to Information and Support: Customers can quickly find information about their policies, coverage details, and FAQs within the app. Additionally, features like chatbots or live chat support can offer instant assistance, answering questions and resolving issues faster than traditional customer service channels.

These benefits not only improve the customer experience but also position the insurance company as a modern, customer-focused, and technologically advanced provider.

Company Benefits

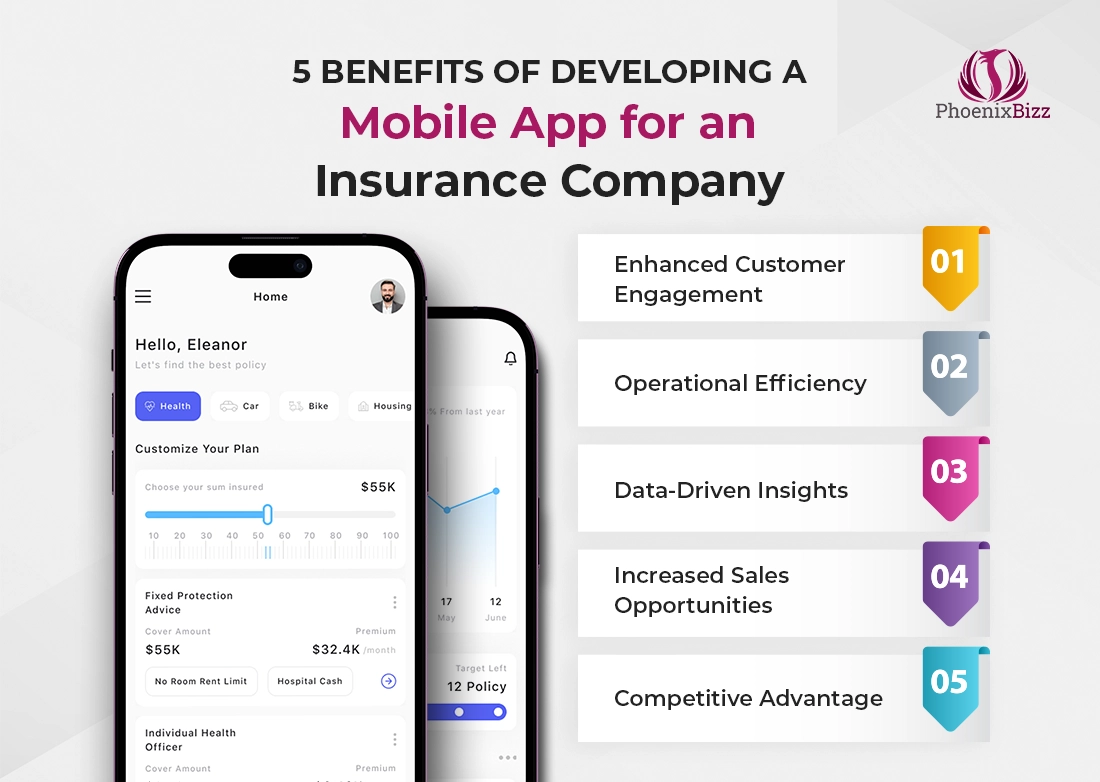

Developing a mobile app for an insurance business can bring several strategic advantages to the company itself. Here are five key benefits:

1. Enhanced Customer Engagement: A mobile app allows insurance companies to maintain constant engagement with their customers through notifications, updates, and personalized communication. This continuous engagement helps in building a stronger relationship with customers, fostering loyalty and retention.

2. Operational Efficiency: By digitizing processes such as claims submissions, policy renewals, and customer inquiries, a mobile app can significantly reduce the workload on the company's staff. This streamlining of operations not only saves time but also reduces operational costs, making the business more efficient.

3. Data-Driven Insights: Mobile apps can collect a wealth of data on customer behavior, preferences, and interactions. This data can be analyzed to gain insights into market trends, customer needs, and the effectiveness of marketing strategies, enabling more informed decision-making and strategic planning.

4. Increased Sales Opportunities: With features like instant quotes, easy policy comparisons, and direct in-app purchases, a mobile app can serve as a powerful sales tool. It can attract new customers, cross-sell or upsell services to existing ones, and drive revenue growth.

5. Competitive Advantage: Offering a user-friendly and feature-rich mobile app can set an insurance company apart from competitors. It demonstrates a commitment to using technology to improve customer service and can attract tech-savvy customers looking for convenience and innovation in their insurance provider.

By investing in a mobile app, insurance companies not only enhance their service delivery and customer satisfaction but also position themselves for growth and success in a digital-first market.

Feature Stack Value-Adds to Consider for Your Insurance Mobile App

Numerous insurance companies are offering several services through mobile apps. The tough task here is to stand out from the crowd. Apart from offering the basic and popular features, you should also add some advanced features to make it unique. With a plethora of different service providers, your mobile app should resonate with the audience.

Features to Consider

For an insurance company looking to develop a mobile app, incorporating features that enhance user experience, streamline processes, and provide value is crucial. Here are ten features that should be included as essential for your company’s customer base:

#1. Policy Management: Allow users to view, manage, and renew their insurance policies directly through the app. This includes accessing policy details, coverage limits, and terms.

#2. Claims Submission and Tracking: Enable customers to file insurance claims easily by uploading photos, documents, and other necessary information. Additionally, offer real-time tracking of claim status to keep users informed throughout the process.

#3. Digital Wallet for Insurance Cards/Documentation: Implement a digital wallet feature where users can store and access their insurance cards and any related documents. This ensures that customers always have their information readily available when needed.

#4. Payment Gateway: Integrate a secure payment gateway for premium payments, policy renewals, and purchasing additional coverage. This feature should offer multiple payment methods for user convenience.

#5. Customer Support and Live Chat: Provide instant access to customer support through live chat, chatbots, or a direct call feature within the app. This helps in resolving queries and issues promptly, enhancing customer satisfaction.

#6. Telematics and Usage-Based Insurance (UBI): For auto insurance, include telematics features that track driving behavior and offer personalized insurance rates based on the data collected. This encourages safe driving and can lead to lower premiums for responsible drivers.

#7. Personalized Alerts and Notifications: Send personalized alerts and notifications for policy renewals, payment reminders, claim updates, and tailored insurance offers. This keeps customers engaged and informed.

#8. Quote Generation and Policy Comparison: Allow users to get instant quotes for various insurance products and compare different policies. This aids in making informed decisions without the need to consult an agent directly.

#9. Educational Resources: Provide valuable resources such as articles, FAQs, and videos on insurance topics, coverage options, and how to maximize benefits. This helps in educating customers and enhancing their decision-making process.

#10. Feedback and Surveys: Include a feature for customers to provide feedback on their app experience and services received. This can help the company in gathering insights and making necessary improvements.

Incorporating these features into the mobile app will not only meet the basic expectations of today's insurance customers but also provide a competitive edge by offering a comprehensive, user-friendly digital experience.

Budgeting Your Project

Every mobile App development company has their own take-off and fee schedules used to develop the multitude of mobile apps in the marketplace. The marketplace has a million service providers offering millions of pricing solutions. That said, crafting the right budget plan can save you from overpaying for mobile app development work. Keep the following points in mind when budgeting your next project.

◾Project Deadline: Planning ahead is key. Engaging with a developer well in advance of your desired launch date can save costs. Rushing the development process will incur additional charges for expedited delivery. It is advisable to allocate extra budget if you anticipate needing faster turnaround times to meet specific deadlines.

◾Tailored Features: Customization is often essential for standing out in the market. While leveraging off-the-shelf solutions with added features can be cost-effective, opting for fully customized app solutions might be more expensive initially but can offer greater value in terms of uniqueness and user engagement. Consider the long-term benefits of investing in custom features that align closely with your business goals and user needs.

◾App Platform: Deciding between iOS, Android, or both can dramatically affect your budget. Cross-platform development allows your app to serve a wider audience by being accessible on both iOS and Android devices. While this approach can increase upfront costs compared to developing for a single platform, it provides broader market reach and can be more cost-effective than maintaining two separate codebases.

◾User Interface Designs: The user interface (UI) plays a critical role in user experience. Investing in high-quality, engaging, and user-friendly UI design is essential for user retention and satisfaction. This might increase the development budget due to the need for skilled designers and more intricate planning, but it pays off by enhancing the overall appeal and usability of your app.

◾Advanced Features: Incorporating advanced features such as real-time data analysis, artificial intelligence (AI), and machine learning (ML) can significantly enhance app functionality and user experience but also raises development costs. These technologies require specialized expertise and more development time. Carefully evaluate which advanced features are essential to your app's success and budget accordingly.

By considering these factors during the budgeting phase, you can make informed decisions that balance cost with the quality and functionality of your insurance mobile app. It is about finding the right mix of features, design, and technology that aligns with your business objectives and user expectations while staying within your financial constraints.

Common questions asked about insurance mobile app development

In what ways can a mobile app be developed?

In broad strokes, mobile apps can be developed through three main approaches. These include.

1. Native Mobile Development: This approach involves creating separate apps for each platform (iOS and Android) using platform-specific programming languages.

2. Cross Platform Mobile Development: This approach uses frameworks like React Native or Flutter to build a single app that runs on multiple platforms.

3. Web-Based Mobile Development: Where mobile web applications or progressive web apps (PWAs) are created to run through a browser on a mobile device, offering a near-native experience without the need for app store downloads.

What are your charges for insurance mobile app development?

PhoenixBizz provides quality custom app development solutions as highlighted by over two-hundred past projects nationwide. That said, software companies typically charge for their services using one of four development models: fixed-price contracts, where the total cost is agreed upon before the project starts based on a detailed project scope; time and materials contracts, where billing is based on the actual time spent and resources used; retainer agreements for ongoing services, providing access to dedicated resources or teams for a set fee; and equity or profit-sharing models, especially for startups, where services are exchanged for a stake in the business or a share of profits.

How do I find the right software development company for my insurance mobile app project?

Beyond the otherwise minimum traits, a dependable mobile app development company will always be transparent, & have impeccable communication skills, but to find the right software development company for your insurance mobile app project, start by identifying companies with specific experience in insurance apps and mobile technology. Evaluate their portfolio for relevant projects and check client testimonials to assess their reliability and quality of work. Consider their technical expertise, especially in cross-platform development if targeting both iOS and Android users. Ensure they have a clear communication process and are within your budget. Finally, request proposals from your shortlisted companies to compare their understanding of your project, approach, timeline, and cost.

You may also like to read: A Step-By-Step Guide To Developing A Custom Personal Finance Management Application For The General Public

Key Takeaways

With 307 million smartphone users in the US, mobile apps tap into a huge market. The complex and challenging nature of insurance business tasks and sales targets are made more manageable through mobile app development. These apps offer quick services and facilitate direct communication between insurers and insurance companies.

Whether it is vehicle, health, or life insurance, mobile apps can benefit all kinds of insurance businesses. They meet the modern audience's demand for convenience, providing everything they need at their fingertips. Your insurance mobile app can effectively close the gap between insurance agents and their target audience, enabling instant connection.

When you begin your search for a mobile application development company that harnesses cutting-edge technology to boost profits, PhoenixBizz stands ready to help. Our client base spans a diverse range of industries, and we pride ourselves on two decades of delivering top-notch software solutions. From insurance websites, applications and mobile applications for the Google and Apple platforms, we guarantee perfect results.

As a branch of Sofvue, LLC, and Data Titan, PhoenixBizz has carved in the mobile app development sector, and we have been developing mobile application solutions since 2010. Catering to both B2B and B2C sectors, we provide highly responsive and premium quality software solutions. To learn more, contact us at 623-845-2747.

RE: 11739

Citations

https://www.statista.com/statistics/201182/forecast-of-smartphone-users-in-the-us/

https://www.statista.com/statistics/1192960/forecast-global-insurance-market/