January 01, 2024

By: PhoenixBizz Staff Writer

PhoenixBizz is a division of Sofvue, LLC

Printed with permission of Data Titan and Sofvue LLC

The struggle with personal finance management is a common issue faced by many people, and it stems from a variety of factors including a lack of financial education, financial products too complex for many consumers to understand, to name a few. Many individuals do not receive formal education in personal finance, which is why so many people find themselves in debt, with low credit scores and paying higher than usual interest rates. It’s actually very sad that most schools often do not include comprehensive financial literacy courses, leaving many without the basic skills needed to manage their finances effectively.

The financial market is briming with an array of intricate products, making it a daunting task for individuals to navigate and make well-informed choices regarding investments, loans, insurance, and retirement planning. Developing an easy to navigate application has untold financial gain. These applications cater to a diverse range of users, offering you an opportunity to connect with a broad customer base.

Manage Your Finances: Defining Finance Tracking Applications

A personal finance management application serves as a pivotal tool for fostering financial independence. These mobile applications, available on various platforms such as smartphones and tablets, are excellent resources for managing money effectively.

These apps offer a suite of features for efficient financial management and encourage fiscal financial habits. They enable users to track their spending, categorize expenses, and gain insights into their expenditure patterns. Budgeting tools within these apps allow users to set spending limits, receive alerts when these limits are exceeded, and exercise greater control over their finances. Here's what a finance management application can offer its users:

✅ It assists in creating a monthly budget to enhance savings.

✅ The application or mobile app tracks your expenses, aiding in identifying areas for cost reduction.

✅ Synchronizing your bank account with the web-based application or mobile app ensures a safe and secure banking experience.

✅ It also provides timely reminders for upcoming bills and equal monthly payments.

Must Read: Custom Financial Software Application System: A Step-by-Step Planning Guide

Finance Management Application Security

Personal finance management apps leverage your banking details and other essential data to streamline your daily financial activities. It's common for new users to feel apprehensive about using these apps due to concerns about data theft and privacy. Recognizing the significance of entrusting your personal information to an app, we've included this section to highlight the key security measures implemented by a seasoned finance application development company, referring to Phoenix Bizz, of course, to ensure the best possible security protection.

Login Authentication

To ensure that only authorized users can access their financial data, many apps incorporate multi-factor authentication. This security measure might involve answering personal questions, using a secure password or PIN, providing biometric data, or using fob keys, ensuring that you are the only one who can access your financial information.

Encryption Technology

To safeguard data during both transmission and storage, finance apps utilize advanced encryption methods. This means your financial data is converted into a secure, scrambled code, effectively turning it into a locked box that only you can access.

Regular Application Updates

An application that isn't regularly updated can become vulnerable to security breaches, putting users' financial and personal information at risk. However, a personal finance management app that is frequently updated remains highly secure. Opting for a finance application development company with a strong focus on security ensures enhanced protection and safety for your data.

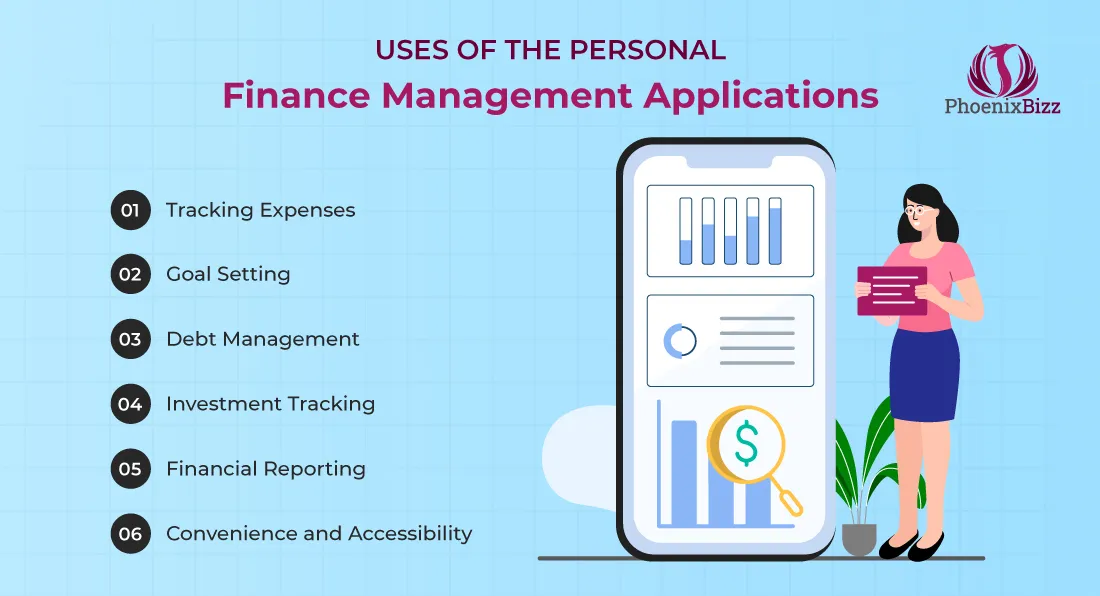

Uses of the Personal Finance Management Applications

How large is the personal finance marketplace? Data shows that the number of online banking users in the USA is expected to reach 217 million by 2025. These numbers speak volumes about the popularity of these applications since people prefer to access their banking information on the go. Here is what consumers use these applications for:

1. Tracking Expenses

When people frequently ask themselves, "Where did all my money go?" at the end of each month, it's a clear sign that a finance management application should be in their future. Many people incur significant expenses and later struggle to recall how they spent their money. The core of personal finance applications lies in their expense tracking system. These apps offer a structured approach to budget management by logging your expenses, categorizing them, and displaying all your transactions. Functioning like an electronic ledger, they keep you informed about your spending habits, helping you gain better control over your finances.

2. Goal Setting

Many personal finance applications allow you to set financial goals, like saving for a vacation, buying a home, or preparing for retirement, and track your progress towards these goals.

3. Debt Management

These tools can help you plan and strategize the best ways to pay off debts, such as credit cards or student loans, by providing insights into interest rates, repayment timelines, and more.

4. Investment Tracking

For those who invest, personal finance software can track the performance of your investments, providing insights into your portfolio's health and helping you make informed decisions about buying or selling assets.

5. Financial Reporting

These applications can generate detailed reports on your income, expenses, net worth, and more, which can be useful for understanding your financial situation over time or preparing for tax season.

6. Convenience and Accessibility

With mobile app options, you can access your financial information anytime, anywhere, making it easier to stay on top of your finances on the go.

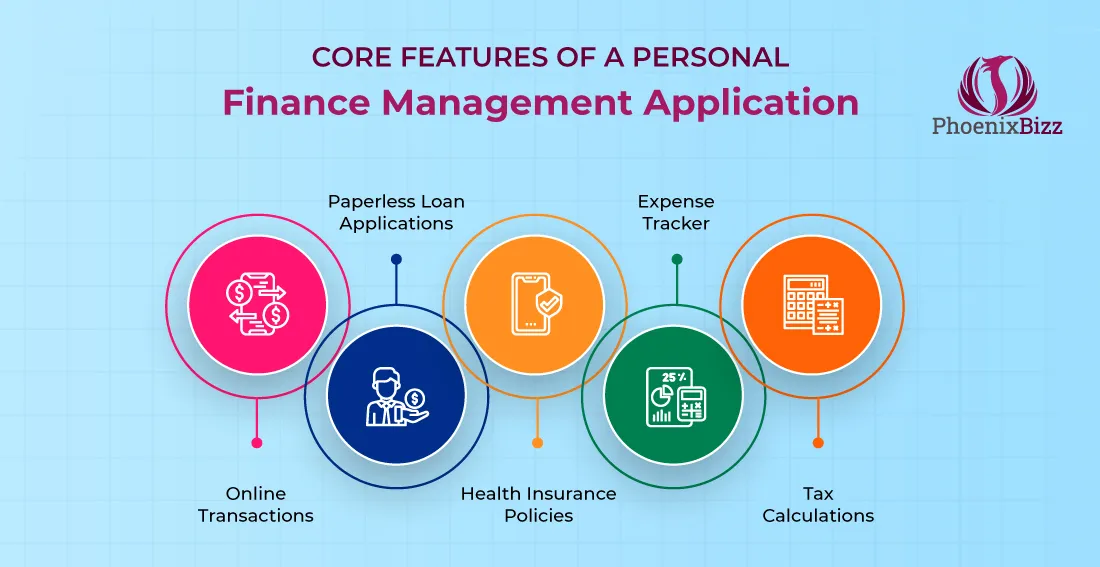

Core Features of a Personal Finance Management Application

#1. Developing a finance management application involves thorough research and detailed analysis

You have a wide array of both fundamental and sophisticated features to consider incorporating into your app. The success of an application hinges significantly on its functionality, performance, design, and user-friendly attributes. Before diving into the essential features list, let's first explore key considerations to keep in mind when deciding on the features for your personal finance application:

● Analyze the usage patterns of your target audience.

● Study what your competitors are offering.

● Conduct surveys among your target audience and employees to better understand user requirements.

#2. List of Core Features

As a consumer, here's how you can benefit from the core features of personal finance applications:

➤ Online Transactions: These apps make transferring money a breeze. You can quickly send funds with just a few taps, entering your password or security PIN for safe transactions.

➤ Paperless Loan Applications: If you need a personal, educational, or other type of loan, you can apply directly through the app, without the hassle of visiting a bank. Simply submit your request via the app, and bank representatives will guide you through the process.

➤ Health Insurance Policies: A standout feature of some personal finance apps is the ability to browse and purchase health insurance policies for you and your family, all within a dedicated section of the app.

➤ Expense Tracker: By syncing your personal details, these apps enable you to monitor all your expenses. This includes monthly payments, credit card bills, and day-to-day spending, helping you stay on top of your finances.

➤ Tax Calculations: Calculating taxes can be complex, but personal finance apps simplify it. They allow you to categorize and track tax-related expenses, like charitable donations, medical costs, and business expenses, aiding in maximizing deductions. The app generates detailed financial reports, making tax filing easier, reducing errors, and potentially helping you save on taxes, either by increasing your refund or reducing what you owe.

These features not only streamline financial management but also offer convenience, security, and potential savings, making them valuable tools for any consumer looking to manage their finances more effectively.

Factors to Consider in Developing a Personal Finance Management Application

◾Understanding your requirements

When developing a personal finance application for your business, it's essential to start with a clear objective. Your app could address various financial challenges faced by users, such as cost management, budgeting, or investment tracking. The key is to identify the specific needs of your target market and tailor your app's functionality accordingly.

In terms of features, consider integrating sophisticated reporting and charting systems, scheduled payment alerts, or connectivity with banks. These features can significantly enhance user experience and provide practical value.

For market and competition research, conduct a thorough analysis to understand the financial needs, desires, and problems of your target audience. Examine competing applications to identify any gaps in their offerings and strive to provide more useful solutions. Utilize surveys, group activities, or online research to gather innovative ideas and validate the demand for your application.

During the application development phase, focus on writing high-quality code to create a robust and error-free application. Your development team should leverage their expertise in programming languages to ensure the app is efficient and effective. Prioritize cross-platform compatibility and a user-friendly interface for smooth navigation and a positive user experience.

Finally, testing is a critical stage. Ensure that your application undergoes multiple rounds of testing to guarantee its performance, responsiveness, and optimization. This step is vital to deliver a unique and high-quality mobile application that stands out in the market.

By following these steps, you'll be well on your way to creating a personal finance application that meets the needs of your users and distinguishes itself in the competitive landscape.

You may also like to read: Understanding how AI Based Mobile Apps, Deployed by Small Business Insurance Firms, Impact the Marketplace

Personal Finance Management Application: Answering Your Questions

As a business owner, how do you ensure the quality of your finance management applications?

Our approach prioritizes a responsive and functional application. We leverage technologies like artificial intelligence, machine learning, data analytics, and IoT to achieve this. Our team is comprised of experts, some with decades of experience, in their respective fields.

Regarding the development costs for a finance management application, our pricing structure varies based on client requirements. We take into account factors such as project size, scope, application design, and responsiveness before providing a quote. For more detailed information, you're welcome to contact us at 623-845-2747.

When it comes to the top specifications of a personal finance management application, the exact features will be tailored to your specific needs. Common specifications often include tax calculation, budget tracking, one-time password authentication, and credit score calculations.

Key Takeaways

Managing personal finances has become more straightforward with specialized finance management applications. These apps are equipped with optimal and advanced features to assist users in managing their finances effectively. If you're looking to scale your business with a finance management application, PhoenixBizz is ready to assist.

With two decades of experience in SaaS and mobile application development, we've designed and developed solutions for over 200 companies across various industries and from coast-to-coast. Our team, consisting of architects, engineers, designers, developers, analysts, and coders, is dedicated to developing applications that not only meet your business needs but also yield maximum ROI.

At PhoenixBizz, we take pride in our precision and commitment to serving our clients. Since 2004, we've been a leader in the industry, continually striving to provide the best services using the latest technologies. For more information about our services, read letters of recommendation, or to watch client “Exit Interviews” and case study videos, please call us at 623-845-2747.

Citations

https://www.statista.com/statistics/1285962/digital-banking-users-usa/

RE: 11706